As a U.S. citizen when traveling or moving abroad, one must make sure of at least two things, having and holding onto a valid passport, and having access to cash. Years ago I landed at Charles de Gaulle airport in Paris, went to grab a quick drink, and had my wallet stolen within 30 minutes of landing. No cash. Those were the days, however, of traveler’s checks, so I spent the next 10 hours in line at the American Express with several hundred other losers to obtain cash for lost checks. Remember you’re not in Kansas anymore. A friend recently had his entire Wells Fargo account frozen while in Serbia, with the only recourse being returning to the U.S. to unfreeze it.

Perhaps the most fundamental way to strengthen your bank financing is structural. By that I mean that you should have several simple tiers of money management that will allow you to become less likely to be compromised. Set up the following three account structures for personal protection.

Personal Checking Account: This account is used for personal reasons, like paying bills, and anything not travel related. You will have an ATM card with this account but do not use it. Keep it safely secured in a safe or a safe deposit box. This account is where your paycheck via direct deposit will go. All your monthly debits should be paid from this account. Only a nominal amount of money (less than $500) should remain in this account after paying your monthly obligations. The rest will be transferred to a second checking account and a savings account.

Second Checking Account: This account should be set up in a different bank from that of the previously mentioned personal checking account. We will discuss which banks to use later. This account should be funded with money transferred from the personal checking account in an amount needed to provide for your monthly living expenses. Depending upon your lifestyle, only put an amount of money in this account that you are willing to lose. This account will also have an ATM card that you will use, thus making it vulnerable to hacking. If you limit the amount of money you place here, you know your absolute downside if hacked. Also, depending upon the bank, you most often will get this money back.

Savings Account: The savings account can be set up in either bank one or bank two, but will have no ATM and thus no outside contact. Only hacking into the system or your assets being frozen by the institution could affect your account. As the name suggests, savings should be primarily a one-way capital flow. Depending upon the amount of money you have, multiple savings accounts or other investment accounts can be incorporated into the structure.

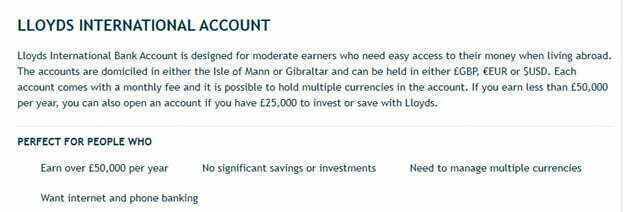

The following is a snapshot of several banks that are recommended for foreign travelers, workers and expats by the website Experts for Expats.

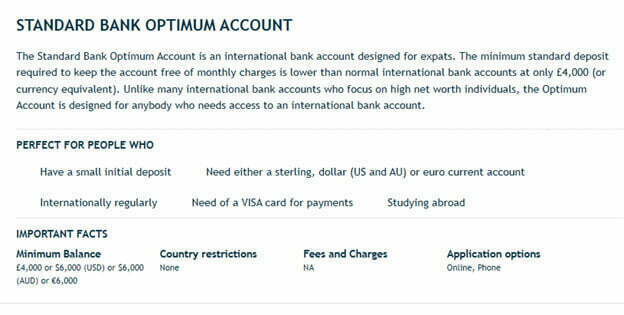

These are the best banks that are recommended for foreign travelers, workers and expats by NerdWallet.

Utilize the structural guidelines given and diversify your risk by using multiple recommended banks.