The time has come. You’ve been thinking about this for years and a plan needs to be put in place to transfer the family business to your next of kin. The reasons abound as to why. Perhaps you are going to retire and wish to entrust the business with a family member who you know will run it well. Either that or you may just want to sell the business to a family member or give it to them as a gift. Regardless, you need to do so without incurring debt and paying as little taxes as possible. Just look at Elon Musk, who will pay $11 billion this year in taxes to the IRS.

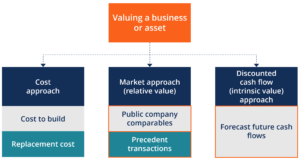

Wealth management in regard to the sale of a family business generally centers on retirement. In the vast majority of cases the business is the retirement plan for the entrepreneur. According to Judith Anderson, senior vice president, Retirement Personal & Wealth Solutions, Bank of America, “Small business owners typically re-invest their profits back into running their business and generally do very little planning ahead for a retirement that may be 5, 10, 15 or more years down the road.” The decision regarding selling the business will largely center on what the business is worth. In many instances the small business may hold a large portion of its value in the goodwill of the owner. You have been the face of the business for years in dealings with clients, banks, new sales and more. How will this affect the value going forward? If you determine that there is a significant ongoing value without you, then the next step is to obtain a valuation. There are many ways to value your business, from using comparable multiples of other firms in your industry, to doing financial models that include forecasting your net present value. This is beyond the scope of this article, but suffice it to say that a professional valuation and tax expert can help you look past your emotional attachment to the company, gauge its true value as well as the market for such a business, and arrive at a realistic number.

Once a professional valuation is determined, the next step is to look at the methods of transferring business ownership. In general, owners can do the following:

- Sell the business

- Reapportion ownership among multiple owners

- Lease the business

- Transfer ownership via gifts or bequests

Selling the business will result in the owner receiving cash for the determined valuation. This can come solely by the means of the purchaser, but more likely through a combination of cash and debt financing. In addition, the owner often times can provide financing in order to make the sale happen. This way the buyer pays for the business over time on terms agreed to with you. If you are involved in a partnership or an LLC with other partners or members, usually your partnership agreement or articles of organization will specify any rights of transfer. Another option is to enter into a lease-purchase agreement. In a lease-purchase, the lessee leases and runs the business for the lease period. Lease-purchases can work effectively if the lessee wants to test out the business before purchasing it.

Gifting is an option that many business owners choose, as the tax code has granted them considerable relief. The lifetime federal gift tax exemption for 2021 is $11.7 million for individuals and $23.4 million for married couples. However, you can take advantage of the $5.45 million lifetime exemption that Congress passed towards gift taxes. The giver would normally have to pay taxes on their gifts, but now they can wait until the total value of their gifts has reached $5.45 million before having to pay taxes.

An exit method that is growing in popularity is the private equity firm. These firms have raised equity from capital investors in order to purchase businesses. They will do the same due diligence that any buyer would do in analyzing your business. The market right now is very hot for businesses looking to sell to private equity groups. Typically in this deal you will stay on to run the business for a number of years, known as handcuffs, which allows the equity group to hold onto your expertize until they feel confident that the new management is capable of running the company.

Obviously before you enter into one of these types of transactions to sell the family business, consultation with an estate planner is important to ensure the success of the business and continuation of the family’s income. A wealth management professional will walk you through the various options with taxes, income, and the ongoing business concerns in mind. You undoubtedly have a business attorney as well, who will help guide you and your financial planner in making the best selling decision.