Investing in oil stocks has always been a no-brainer, and now with war under way between the Ukraine and energy rich Russia it appears to be even more of a sure thing. With oil prices around $100 a barrel and with many analysts seeing it going to $130 or more a barrel it may be time to get in on that next 30% move up. It is intuitive that the correlation between the price of oil and the price of oil stocks is positive. The reasoning behind this is pretty simple. The costs of getting oil out of the ground, transporting it, storing it, and refining it into fuel and other products are essentially fixed. When a barrel of crude oil can be sold for more than the sum of those costs, oil companies make money. But when oil is trading for less than the sum of those costs, at least some of those companies can lose money. With that said, not all oil companies are created equal. They do business in differing parts of the industry, which will have a direct effect on how oil prices effect their stock prices. Let’s look at some of the main sub-sectors of the oil and gas industry first.

Exploration and Production Companies: As the name would suggest, these companies are involved in finding oil and gas. Once discoveries have been made they are in the business of drilling and getting it out of the ground. Probably the best known and largest in the category is ConocoPhillips (COP).

Midstream Companies: These companies are the middlemen in that they transport and process product that will eventually be refined into petroleum products. They are less sensitive to the fluctuation in oil prices.

Downstream Companies: Companies that refine crude oil into other products like fuel or petrochemicals or sell refined products to consumers. Gas station operators and refinery operators are two types of downstream companies. Phillips 66 is a major downstream company.

Integrated Companies: These are the companies that are known as Big Oil and are involved in just about every aspect of the supply chain. ExxonMobil is the largest of this group.

With an understanding of how the industry is structured, let’s take a look at 5 of the best stocks to place your money into during this time of rising oil prices.

Exxon Mobil is the largest oil company in the U.S., and as you can see on the above chart its stock price has risen steadily since the beginning of 2022. Analysts from Truist, RBC Capital Markets and Argus have all recently upgraded the stock and have price estimates as high as $92 a share. Throw in Exxon Mobil’s 4.5% dividend and you have one of the best current plays on oil and gas.

EOG Resources, Inc. is an American energy company engaged in hydrocarbon exploration. It is headquartered in Houston, Texas and is currently ranked 186th on the Fortune 500 and 337th on the Forbes Global 2000. EOG Resources is also one of the largest U.S. oil and gas exploration and production companies. In the event that the Biden administration decides to once again pursue increasing domestic oil production, EOG is poised to profit. Roughly 25% of EOG’s liquid-rich assets sit on federal land and could be tapped to add value to the security. Like Exxon Mobil, analysts from Truist and Bank of America Securities have upgraded the stock and put a buy rating on it with a high price target of $135 a share.

Chevron Corp. is a major U.S. oil producer with word-wide interests. As you can see from the chart above its stock price has increased some 40% since the end of September 2021. Chevron’s upstream business was much more profitable than Exxon’s in 2021, and the company has long-term growth opportunities in low-carbon solutions, renewable fuels and hydrogen. Chevron was one of the few oil majors that didn’t cut its dividend during the 2020 downturn. Chevron is one of the best in the business, and is well positioned to stick around over the long term and serve its customers even if renewables eventually overtake oil and gas.

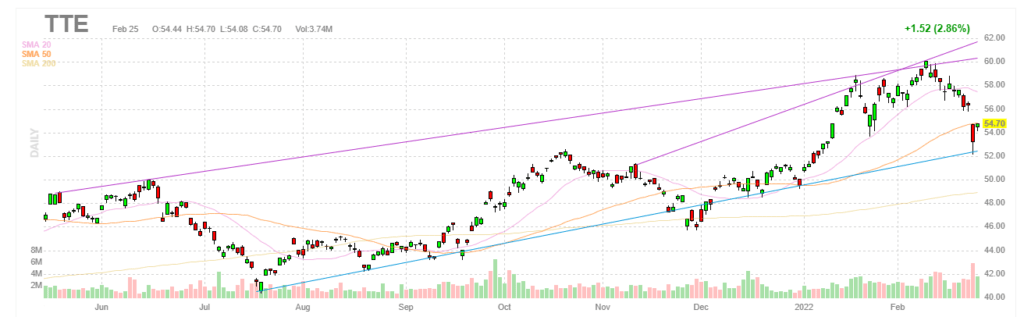

The search for the best investments in oil and gas leads us to TotalEnergies, which is a major French producer and can give investors exposure to this category outside of the U.S. Among other things, TTE has a defensive upstream asset portfolio centered on low-cost liquid natural gas projects. The short-term pullback in its stock price to the 200 day moving average could signal a buy sign. The stock’s average price target among a variety of analysts is $63.80, according to The Wall Street Journal.

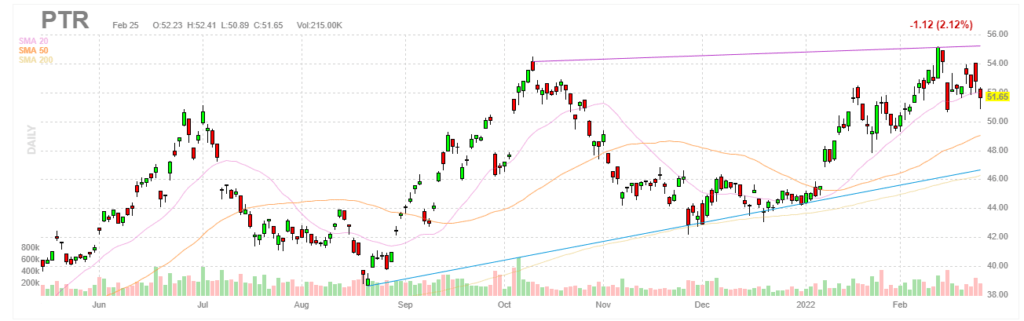

If you put geopolitical tensions aside and look at PetroChina as a pure play on oil and gas there is profit to be made. PetroChina is the largest oil and gas producer in China. Despite broad weakness in U.S.-listed Chinese stocks due to concerns over regulatory crackdowns and potential delisting’s, rising energy prices have sent PetroChina shares up about 68% in the past year. This pick would be the most speculative of the five merely based on its Chinese origin. With the stock trading at less than 50% of its book value there is a compelling story here for those with a little more appetite for risk.