The upside to a capitalistic economy is untethered entrepreneurship that ebbs and flows with the supply and demand needs in the current marketplace. Truly a wonderful and innovative system. The downside is that in such an economy supply and demand can become unbalanced and we can fall into periods of recession and even depression. As brilliant as today’s technology is there is still really no way to forecast when a major downturn in the economy may take place.

There are a couple of macroeconomic indicators that are telling us to be careful currently. Inflation is at the top of the list, with the latest CPI numbers showing at 8.5%, the highest seen in some forty years. One thing that is different now from the stagflation economy of the 80’s is the labor market. We have hit post-pandemic unemployment lows with jobless numbers at roughly 3.5%. That is right about where the Fed wants it to be. Inflation, however, has soared beyond the target rate of 2%.

The good news here is that with such a tight labor market we shouldn’t enter a stagflationary economy. With no crystal ball, that doesn’t mean that can’t change in a New York minute. One only has to think of how then Fed Chairman Paul Volcker crushed inflation and returned balance to the economy, inflation wise, until recent periods.

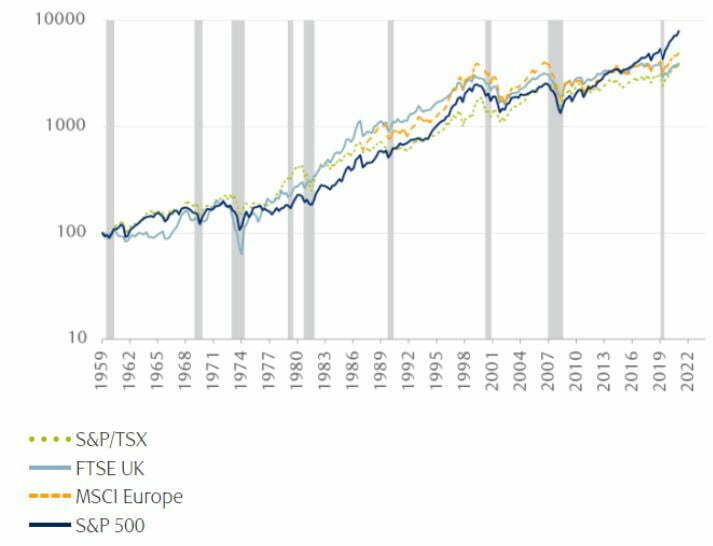

According to RBC Wealth Management, all U.S. recessions, which are the shaded areas in the chart below, have been associated with equity bear markets.

So what exactly is a recession and how is it measured. A recession refers to a period of declining GDP and is generally defined as a sustained decline for two or more consecutive quarters. Whereas the more draconian depression is a severe and prolonged downturn in economic activity. In economics, a depression is commonly defined as an extreme recession that lasts three or more years or which leads to a decline in real gross domestic product (GDP) of at least 10%.

With all that in mind, you may wonder if investing is a good idea if we’re in a recession or are headed in that direction. Is it wiser to take every dollar you make and keep it in cash? Let’s take a look at some historical data and put investing in a recessionary environment into context.

We will look at data from three recent recessions prior to the COVID-19 pandemic, the Great Recession from 2007-2009, the recession in 2001 fueled by the dot-com crash and the 9/11 attacks, and the 1990-91 recession that followed a long economic expansion in the 1980’s.

According to Mathew Frankel, CFP with The Motley Fool, “If you had invested in an S&P 500 index fund at the worst possible moment in 2007, the market’s peak before the financial crisis began, you would have achieved an 8.4% annualized return in the 15 years since. If you had bought at the highs before the 1990-91 recession, you would have achieved a 9.8% annualized return in the nearly 30 years since.” Not too shabby. Timing the markets is difficult, especially in or around a recession. This is why dollar-cost averaging is such a beneficial way to invest in the markets.

By investing like amounts at regular intervals in the S&P 500 or whatever security you select, you would have outperformed the previously mentioned numbers because you wouldn’t have bought at exactly the wrong time with all of your funds.

So how do you position yourself with expectations of a looming recession? The historical go-to’s are still there. Gold and bonds, U.S. government as well as investment-grade corporates, have historically fared best during recessions, while high-yield bonds and commodities have traditionally suffered alongside stocks.

As mentioned above, dollar cost averaging into the market via the S&P 500 or other bellwether indices has a proven track record of success. Stock picking during periods of recession comes down to what you might think, historically stable companies with strong cash flow.

The safest stocks to own in a recession are those of large, reliably profitable companies with a long track record of weathering downturns and bear markets. Companies with strong balance sheets and healthy cash flows tend to fare much better in a recession than those carrying heavy debt or facing big declines in the demand for their products.

This is why you see the NASDAQ typically drop more than the Dow Jones or the S&P. The NASDAQ is composed of more technology and leveraged companies than the other major indices and is much more negatively correlated to rising interest rates.

If you want to break it down a little further, you can take a look at individual sectors that might be likely to perform better during these tough times. People are still going to spend money on medical care, household items, electricity, and food, regardless of the state of the economy. As a result, these stocks tend to do well during busts and may be sectors that you want to take a look at.

From a personal finance perspective, there are additional things you can do to carry you through tougher economic times. The first is to try to tackle any debt that you might have, particularly high-interest credit card balances. As the Fed attempts to reduce inflation by hiking the federal funds rate, your credit card rates will rise as well. It’s not easy though.

A February 2022 Bankrate poll found that 22 percent of Americans have more credit card debt than savings. Paying down any debt will free up cash flow for savings and emergency funds, which will ease the stress in these panic prone situations. Remember again that recessions are inevitable in our capitalistic economy, but also be mindful that they are not always as bad as the Covid pandemic or the Great Recession.

Hopefully these suggestions will help you weather the next economic storm.