Even if the FTX debacle turns out to be the draconian nail in the crypto coffin, the potential fraudulent Ponzi scheme still seemed like an easier pill to swallow than the likes of a made-up Non-Fungible Token (NFT) like the Bored Ape Yacht Club.

Those folks either had too much time on their hands or too much money, or both, but an end to that kind of financial nonsense is justified.

Looking at some of the characters from the Bored Ape Yacht Club, it isn’t hard to believe that Buffett and Munger gave a vehement thumbs down on that whole mess?

With no intrinsic value, numbers were pulled from the sky to place a price on such things like Damien Hirst’s “The Currency” collection, which is down some 10% to $4,672.60. A Bored Ape Yacht Club NFT that Justin Bieber bought for $1.3 million in January is now worth $70,000, according to the Insider. Ouch. Graham and Dodd would be rolling over in their graves.

But you say, wait a minute, that silliness isn’t really what the NFT market is about, it’s just an aside that allows people to interact socially on a different wavelength. The FTX bankruptcy has pushed down the price of cryptocurrencies, shrinking the buying power NFT collectors enjoyed in the past.

Most collectors buy NFTs using cryptocurrency, although many marketplaces also accept traditional payment options like credit cards. An NFT gives someone proof of ownership of a digital object, or access to services, using a unique code on the blockchain that is linked to an image or video.

NFTs can be transferred or sold, but because of their unique codes, they cannot be copied or divided into smaller parts like other tokens.

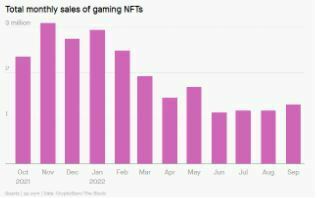

The price decline in cryptocurrencies is just one of the factors affecting the relevance of the NFT market. According to CoinMarket, the crypto market cap has shrunk from $1.02 trillion to $960 billion since early this year. If you think that’s something, the NFT market is down by nearly every trackable metric, in sectors from art to gaming, trading volume for NFTs has plunged about 90% since this time last year, according to data from The Block and Crypto Slam.

However, like crypto itself, the long-term viability of this genre will have everything to do with valid use cases. Digit art is novel but will not support the entire NFT industry going forward. The NFT market’s struggles are yet another sign that blockchain-based digital collectibles are bull market luxuries rather than reliable, inflation-resistant investments.

The gaming faction of the NFT market is also not likely to prop up the sector as a whole. Sales in gaming NFTs are down some 93% year over year.

NFTs are not commodities like the dollar or oil, or even Bitcoin. They create value by being inherently unique and one-of-a-kind. By creating a system of verifiable digital ownership, NFTs fundamentally changed the market for digital assets, creating the possibility for new types of transactions.

Real-world applications of the technology underlying NFTs are a different story. It’s all about blockchain technology, authentication, and security. Nike, for example, owns a patent on NFTs to authenticate sneakers as unique items. The secondary shoe business is $9 billion annually.

Currently, Nike doesn’t get a cut of this. However, by creating product NFTs, code can be written into the blockchain that follows the product and its resale. Every time a new sale is made, Nike could get a cut. Real estate is also active in using NFTs to create 3-D images that allow sellers to virtually visit a property online without actually having to see it.

As with the broader cryptocurrency market in general, NFTs will have to have real-world use cases for them ever to become viable again. There are still those who are bullish on this space. Venture capitalist Li Jin, a general partner with the investment firms Atelier Ventures and Variant, argues today’s NFT crash, while driven by macroeconomic headwinds, will lead to a better and more utilitarian NFT market in the future.

Like any financial mania, one can expect that a few diamonds will arise out of the rough. According to Mahesh Vellanki, managing partner at the crypto venture firm SuperLayer, “The bigger story here is not so much that NFTs are down but that the market for them is changing.”

It will pay to be diversified in this asset class as you can’t be sure which new ventures will survive. But it only takes one Amazon in the portfolio at the right time to create generational of wealth.