The past is history, and if you don’t know history, you are likely doomed to repeat the same mistakes previously made.

At least, that’s what noted Harvard philosopher George Santayana said at the turn of the last century.

As it relates to the financial markets currently, one must be aware that during the past year, macroeconomic trends have changed and will likely lead you to investments in areas that you haven’t been too of late.

The Federal Reserve has been the driving force in this saga, with its quantitative easing flooding the markets and consumer pockets with money under the auspices of the Covid pandemic. As such, we find ourselves in a financial environment with ever-rising interest rates and inflation.

The pre-Covid macroeconomic structure and the post-Covid environment for investing are starkly different, and many analysts think the markets are in the genesis of figuring this out. Some $12 trillion in value was erased from the U.S. stock market alone in 2022, with more volatility surely to follow this year.

Remember that to get back the 20% decline in the S&P 500 in 2022, the index has to rise 40% to break even again. The scenario is not sanguine, and according to Goldman Sachs, the S&P 500 is likely to retest the 2022 lows and end roughly 4% higher for 2023.

It’s all about interest rates.

We have had essentially negligible rates for many years, leaving bonds as an afterthought as yields stayed low in comparison to stocks and alternative investments.

So it’s no wonder that technology companies, who generally are more dependent on debt financing, have taken a beating of late. The five largest big tech companies in the U.S. accounted for about 25% of the market’s decline last year.

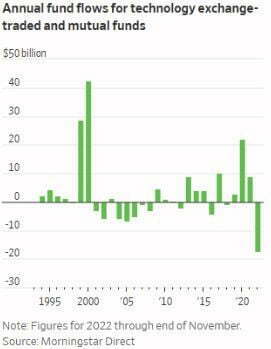

If the current mass exodus from technology is only beginning, then based upon the annual flow of funds for tech mutual funds and ETFs, then the bruising has just begun. “We are in a world where interest rates exist again,” said Ben Inker, co-head of asset allocation at Boston money manager GMO, which oversees $55 billion in assets.

The rosier economic scenario also included unemployment near all-time lows, and remote work (boondoggle) for employees looked like it was here to stay. This was the same time when the not-so-prescient Janet Yellen gave us the term transient inflation and assured us out of the side of her mouth that prices would surely be dropping soon.

With the backdrop now set, let’s take a look at where your money might need to be in the new year.

Keep an eye first and foremost on the Fed and interest rates, as this will dictate investment opportunities for the upcoming year.

Let’s talk bonds.

Morningstar predicts that the Fed will ease monetary policy and lower interest rates to roughly 3% by the end of 2023. If that happens, it won’t help the inflation fight. That suggests that Treasury Inflation Protected Securities (TIPS) and I bonds should remain popular inflation-fighting investments.

Because of the unpredictability of economic events, it is putting pressure on traditional asset allocation models. 2023 may prove that buy-and-hold investors need more than equities and fixed income to hedge against unpredictable markets.

So what else is out there?

If you have the appetite for risk tolerance like you’ve been getting in the equities markets, then alternative investments don’t sound quite as risky. With their low correlation to traditional asset classes like stocks and bonds, alternatives could blunt inflation, and recession-induced volatility and buoy returns more than dividend stocks alone. One of the more popular alternative asset classes is commodities. Previously reserved for accredited investors and seasoned traders, everyday investors can easily access alternative asset strategies through a decent selection of low-cost ETFs and mutual funds.

We’ve mentioned before that one silver lining in the inflation market is savings bonds, particularly Series I savings bonds.

These are the ones that are tracked to the CPI and offered investors a historically high rate of 9.62% last year. These bonds are adjusted every six months, with the latest yielding a very respectable risk-free rate of return available until April 30, 2023, of 6.89%. You probably don’t have the stomach for cryptocurrencies any longer, and we can’t blame you.

The fall of 60% and the fact that forecasts for this year are anywhere from $5,000 to $50,000 on Bitcoin make this still a very risky asset class that should be considered only with money that you are okay losing. On the flip side is renewed interest in renewable resources due to the $1.2 trillion infrastructure bill of 2021 and the Inflation Reduction Act of 2022.

Democrats front-loaded the legislation making trillions of federal investments available for renewable energy projects.