It seems that sometimes it may be practical to be a market contrarian. If you had listened to the prognosticators and the economists last year, you’d be certain that we would be in a full blown recession, with your portfolio in a defensive posture.

Bonds they said, are the new asset class to be reckoned with. Don’t forget cash as well. As Warren Buffett says, you can never have enough cash. Well, we have almost inked the first half of 2023 and you don’t need 20/20 vision to see that there has been no recession. Perhaps that is a bit unfair.

Citi Wealth Management sites that we have been in basically what they would call a rolling recession, where sectors and asset classes have taken turns driving and trailing the economy. The allure of 5% treasury bills sounded pretty good, until the S&P 500 printed 15% returns for the same half year.

That’s 30% annualized.

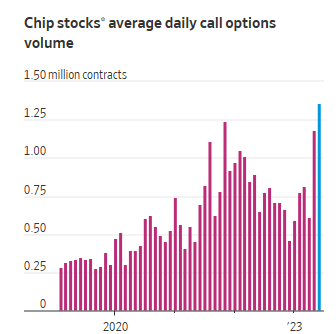

You’re not the only one who wants to get in on a piece of this new bull market. Wall Street traders are placing bullish leveraged bets with options guessing that the recent rally will continue. While bearish bets have been successful targeting certain segments like the regional banking sector, big tech and artificial intelligence and the fear of missing out have propelled the broader markets higher.

Take a look at the daily call option volume in microchip stocks and you’ll get a picture of what’s happening currently. Calls give the right to buy shares at a specific price, by a specific date.

Puts confer the right to sell. According to data from the CBOE, call volume in the S&P 500 has surpassed record daily highs.

It appears now that the only question that remains is whether we may just get another big bounce higher, or will this market gather real steam and keep plowing forward for the longer term.

History shows that big stock market drops almost always are followed by equally impressive rebounds, and experts agree that this scenario should play out again with a serious bounce in the second half of 2023.

Unlike the mantra of philosopher George Santayana, if you don’t know history, you are bound to repeat it, doesn’t quite sit well within market frameworks. Market participants are all too familiar with past moves, yet are consistently confounded with anticipating future direction.

That is largely because the current post-Covid economic environment is unlike any other of the past.

With both inflation and interest rates on the rise, the second half of the year won’t be smooth sailing. However, there are some early signs that things might be looking up.

- Inflation is still high, but rates have been trending down.

- The Federal Funds Rate stands at a 13-year high of 5.07%, but experts agree that the rate increases should stop soon at roughly 5.5%.

- Unemployment, which spiked to all-time highs in the early COVID-19 pandemic, is down to lows not seen since 1969.

Whether the recession is one of the rolling industries or whether it just got delayed doesn’t really seem to matter to market participants.

According to Wu Silverman, RBC Capital Markets head of derivatives strategy, “A lot of people are coming around to the view that the stock market may have already bottomed last fall.”

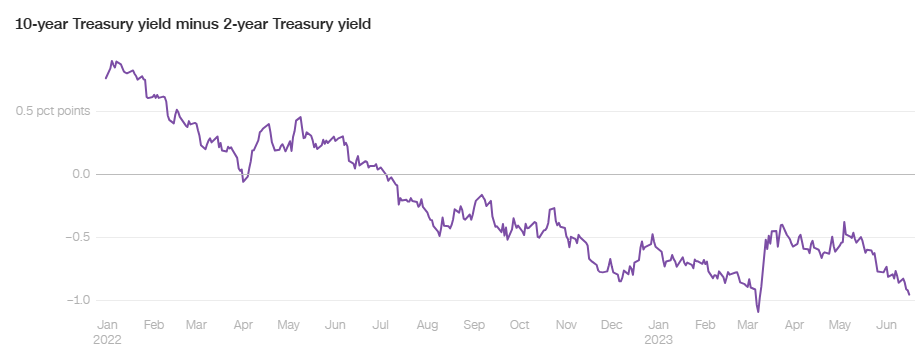

The fear of missing out is psychological and not financial, thus marked with peril. Remember the inverted yield curve? Two-year and 10-year Treasury yield curves are still inverted after inverting last year, which has historically been a recession indicator.

One has to be careful, as the fear of missing out and the exuberance of feeling the need to hop on the train are risky at best. Call options, as mentioned, are short term bets on the market and have no real bearing on the longer term.

That’s why financial advisors generally tell their clients to create a long term investment plan and stick with it.

Other than market traders, experts are mixed on the shorter term direction of the market. According to Sylvia Jablonski, chief executive and chief investment officer of Defiance ETF’s, “I think that we’re likely to end the year up versus down. I don’t necessarily think we’re going to get another 20%, 30% or something like this out of the NASDAQ.” Callie Cox, a U.S. investment analyst at eToro, also cautions investors against counting on a bull market too soon.

“While there’s a very good chance we’ll see another bull market down the road, we’re not sure how much time that could take.” Betting the short term direction of the market is always a difficult task, which bodes well for longer term investors.

History has tons of data showing that the stock market can power through various crises over time. If time is on your side then buy and hold is right for you.