Corn prices significantly influence stock market prices, particularly in sectors like agriculture, food and beverage, and renewable energy. Corn plays a crucial role in the global economy as a key agricultural commodity.

Fluctuations in corn prices can have a domino effect on industries that rely on it as a raw material or for feedstock.

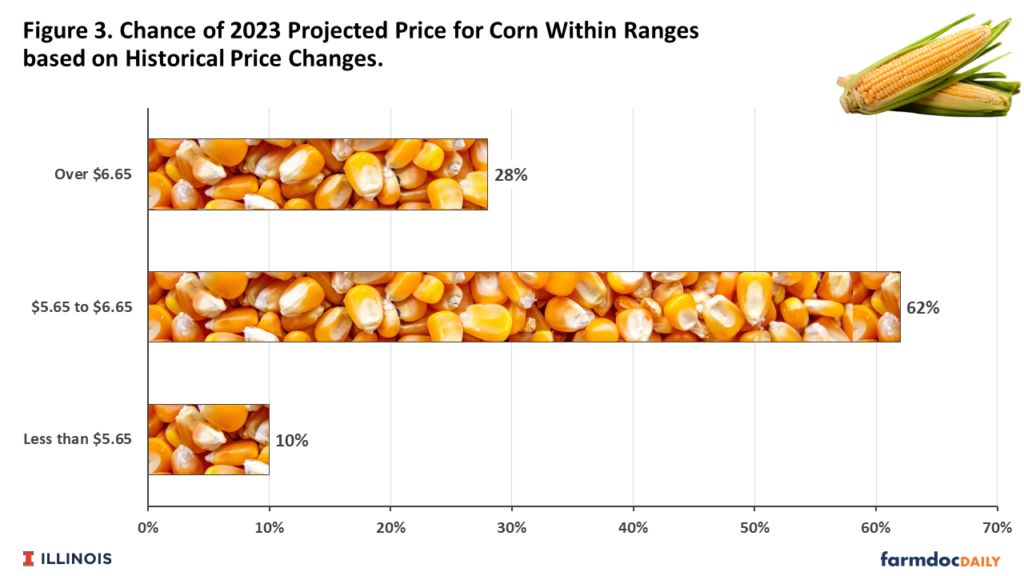

Traders closely monitor several key indicators when analyzing corn prices and predicting future trends. These indicators can provide valuable insights into the factors that influence corn prices and may help determine whether we will witness a decline from current levels.

One important indicator to watch is the supply and demand dynamics of corn. An increase in global corn production and a surplus in supply can put downward pressure on prices. On the other hand, a decrease in production due to adverse weather conditions or increased demand from industries such as ethanol production can push prices higher.

For example, high corn prices can increase production costs for food manufacturers, impacting their profitability and subsequently affecting their stock prices.

Various factors, including supply and demand dynamics, weather conditions, government policies, and geopolitical events influence corn prices. A poor harvest due to adverse weather conditions, such as droughts or floods, can decrease corn supply and increase prices. Conversely, a bumper crop can lead to surplus supply and lower prices. Moreover, government policies, subsidies, and trade agreements can significantly impact corn prices, affecting production levels, imports, and exports.

Macroeconomic indicators, such as GDP growth, inflation rates, and interest rates, can sway investor sentiment and overall market performance. Changes in corporate earnings and profits directly impact the valuation of individual companies and subsequently affect their stock prices. Market sentiment, driven by investor perceptions, emotions, and confidence, can lead to significant fluctuations in stock prices, creating opportunities for gains or losses.

Monetary policies set by central banks, such as the Federal Reserve in the United States, can significantly influence market dynamics. Decisions on interest rates, money supply, and quantitative easing measures can affect borrowing costs, consumer spending, and overall economic growth. Changes in monetary policy can create shifts in investor behavior, asset allocation, and market sentiment, leading to fluctuations in stock prices.

Global events and economic indicators also play a vital role in shaping the stock market. Economic reports, such as employment data, consumer sentiment, and manufacturing indices, provide insights into the economy’s health and can drive market movements.

Even geopolitical events, like trade tensions between nations or political uncertainties, can create volatility and uncertainty in the stock market. Investors closely monitor these events, adjusting their portfolios based on potential risks and opportunities.

History has shown numerous instances where external events have dramatically affected the stock market. Major geopolitical events, such as wars, political instability, or international conflicts, can cause market volatility and uncertainty.

The 2008 global financial crisis serves as a poignant example, where a housing market bubble in the United States triggered a chain reaction of financial market turmoil worldwide.

These various factors create a complex and dynamic stock market environment. Supply and demand forces, economic indicators, corporate performance, investor sentiment, and external events all interact to determine stock prices.