The Biden Administration’s announcement of a new interagency task force aimed at tackling “unfair and illegal” pricing practices by businesses has ignited a firestorm of debate. This blatantly political initiative, led by the Justice Department and the Federal Trade Commission (FTC), is designed to address what the Administration perceives as “anti-competitive, unfair, deceptive, or fraudulent business practices” that allegedly inflate costs for American families.

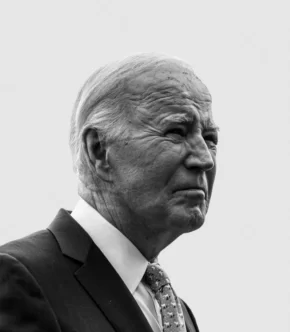

President Joe Biden, who has often vocalized his frustration with what he terms “junk fees” and other pricing strategies, positions this “strike force” as a necessary measure to protect consumers. However, critics point out that it represents a misdirection of focus, attributing economic woes to the actions of businesses rather than acknowledging the potential exacerbating effects of the Administration’s own regulatory policies on inflation and economic growth.

The task force’s establishment was previewed with rhetoric suggesting a direct linkage between corporate practices and the economic burdens shouldered by Americans. “The Administration’s new ‘strike force,’ led by the Justice Department and Federal Trade Commission, will ‘stop illegal corporate behavior that hikes prices on American families through anti-competitive, unfair, deceptive, or fraudulent business practices,'” stated a press release, underlining the Administration’s intent to address these issues head-on.

Yet, this narrative has been met with skepticism from various quarters, with critics pointing to the broader economic context. They argue that the Administration’s approach conveniently overlooks the role of extensive government regulation in inflating business costs, which, in turn, get passed on to consumers in the form of higher prices for goods and services. Daniel Belsky, Ph.D., an associate professor of Epidemiology, hints at this perspective, suggesting that the true aim of this initiative may be more about political optics than genuine consumer protection, especially in an election year.

The focus of the Biden Administration on sectors like healthcare, where it has initiated investigations into the “impact of corporate greed,” particularly with an eye on private-equity firms, has also stirred controversy. Critics argue that this represents a misguided attempt to pinpoint a singular villain in the complex narrative of rising healthcare costs. They point out that factors such as government regulation have played a significant role in shaping the healthcare landscape, including the unintended consequences of policies like the ObamaCare medical loss ratio. This, they argue, has spurred consolidation within the healthcare sector, ironically contributing to the very price increases the Administration now seeks to combat.

Moreover, the broader regulatory actions undertaken by the Biden Presidency, including efforts by the Securities and Exchange Commission and the Consumer Financial Protection Bureau to limit certain business practices, are viewed by some as contributing factors to the economic pressures faced by American families. Each regulatory decision, while perhaps motivated by consumer protection goals, is seen by critics as adding layers of cost that ultimately find their way back to consumers, undermining the stated objectives of initiatives like the “strike force.”

In particular he is after:

- Extra Fees and Hidden Costs: The Biden administration points out that even as prices for some commodities have seen reductions, certain corporations continue to impose additional fees or conceal costs, practices that the task force aims to scrutinize and potentially eliminate.

- “Junk Fees”: President Biden has previously criticized the proliferation of so-called “junk fees,” additional charges that consumers face, which the administration argues do not reflect the actual cost of services or products, but rather, serve to increase corporate profits at the expense of consumers.

- Automatic Inflation Adjustments Used as a Pretext for Fee Increases: The Consumer Financial Protection Bureau has targeted credit card companies for automatically raising late fees annually under the guise of adjusting for inflation, a practice that the new rules aim to curb by significantly reducing allowable late fees.

While these are motherhood and apple pie statements, the magnitude of these “unfair” and/or “deceptive” fees is not something that is impactful in the overall economy, and the ability for the already overworked Justice Department and the FTC to catch people in this is almost non-existent.

At the crux of this heated debate is a fundamental disagreement over the role of government in the economy and the most effective strategies for ensuring consumer welfare and fostering healthy competition. While the Biden Administration portrays its latest move as a necessary intervention to safeguard Americans from exploitative business practices, detractors see it as an ill-conceived effort that risks misdiagnosing the causes of economic distress and potentially hampering economic innovation and growth.

As this debate continues to unfold, the impact of the “strike force” on the economy, businesses, and consumers will be closely watched. Whether it will achieve its lofty goals or serve as a contentious chapter in the ongoing discourse on economic policy and regulation remains an open question, reflecting the complex interplay between government action, business practices, and the wellbeing of the American public.