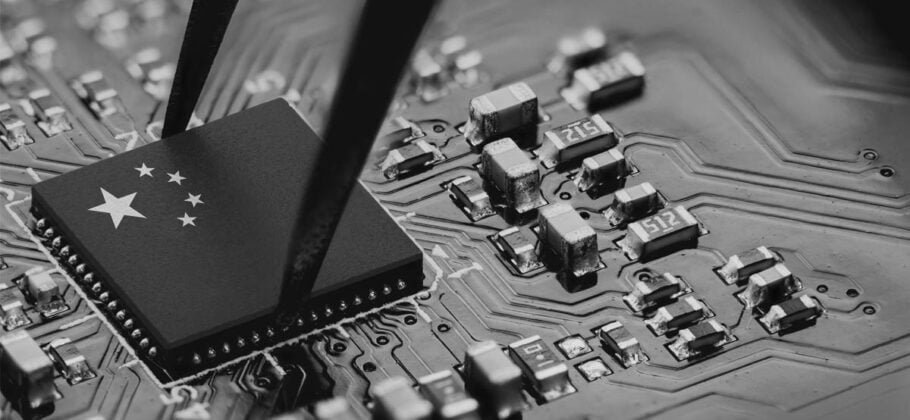

China has embarked on an ambitious venture to bolster its semiconductor industry, a critical battlefield in the tech supremacy contest with the United States. With over $27 billion earmarked for its largest chip fund yet, China’s National Integrated Circuit Industry Investment Fund, also known as the Big Fund, is steering the country towards technological self-reliance and innovation. This move comes as a direct countermeasure to the United States’ intensified efforts to curb China’s advancements in chip and artificial intelligence technologies.

The creation of this fund is not merely a financial transaction; it represents a concerted effort by China to leapfrog into the forefront of semiconductor technology, an area that has become a flashpoint in US-China relations. With the US escalating its technology curbs to thwart China’s technological ascendancy, particularly in the realms of chips and artificial intelligence, the Big Fund’s expansion is a clear signal of China’s determination to break free from these constraints.

“The National Integrated Circuit Industry Investment Fund is amassing a pool of capital from local governments and state enterprises for its third vehicle that should exceed the 200 billion yuan of its second fund,” according to sources familiar with the matter. This statement underscores the magnitude of China’s commitment to its semiconductor industry, emphasizing the significant role that local governments and state enterprises play in this national endeavor.

Moreover, this initiative is strategically aligned with President Xi Jinping’s vision of a “whole nation” approach, pooling resources across the country for major projects. This method is not just about consolidating financial capital but also about fostering an integrated approach to achieving technological sovereignty. As the Big Fund gears up for its largest fundraise to date, it reflects a resolute effort to harness China’s vast resources in pursuit of a self-reliant semiconductor industry.

Investors in the fund, including the governments of Shanghai and other cities, along with entities like China Chengtong Holdings Group and State Development and Investment Corp., are reportedly committing billions of yuan each. This collective investment underscores the broad-based support for China’s semiconductor ambitions, highlighting the strategic importance of this sector to the country’s future economic and technological landscape.

The Big Fund’s approach involves financing not only through direct investments in local firms but also through creating multiple pools of capital managed by various general partners. This “fund of funds” structure aims to diversify investment strategies and deal sourcing, thereby enhancing the robustness and resilience of China’s semiconductor ecosystem. This strategic financial framework is designed to catalyze innovation and support the growth of companies across the semiconductor value chain, from startups to established industry leaders.

Entities that receive backing from the Big Fund gain not just financial support but also a formal endorsement from Beijing, which often opens doors to further investment opportunities and policy support. This endorsement is a significant advantage in the highly competitive and capital-intensive semiconductor industry, enabling these companies to scale up their operations and accelerate their technological development.

Despite the ambitious goals and substantial investments, challenges remain. Reports indicate that leading Chinese tech firms, including Huawei Technologies and Semiconductor Manufacturing International Corp. (SMIC), still rely on technology originating from the US for certain advanced productions. This reliance underscores the complexities of the global semiconductor supply chain and highlights the ongoing challenges that China faces in achieving full technological autonomy.

China’s push to develop its semiconductor industry through the Big Fund is more than a response to international pressures; it is a strategic move to secure its place in the global tech hierarchy. By investing heavily in this critical sector, China aims to reduce its dependency on foreign technologies and pave the way for breakthroughs that could redefine the global semiconductor landscape. As this high-stakes endeavor unfolds, it will not only shape the future of China’s tech industry but also influence the global balance of technological power.

But one should note, this is not “smart” money. The Big Fund is not full of savvy semiconductor investors who know the market and are focused on growth and profit. The money is coming from state development funds, that, frankly, have too much of a communist perspective and will find themselves lacking when it comes to investment acumen in this industry. ACZ experts predict that the impact will be roughly half of the monetary value, the rest going to foolish endeavors and/or to line the pockets of executives of the major semiconductor houses.

This has little in the way of “leapfrogging” capability – but that is not to say it will not be impactful. China has numerous direct pipelines into advanced and proprietary technology from the U.S. and other Western countries, from their network of spies. The fund and the illicit technology pipeline in combination are a greater threat than each as a single threat.