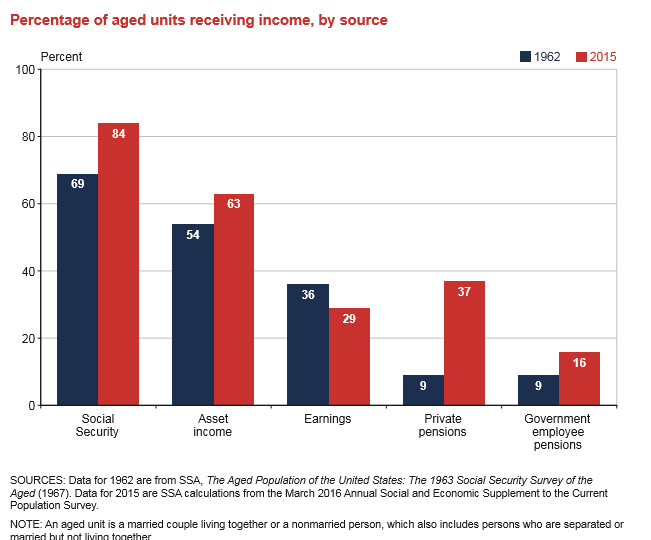

The safety net for Americans that is Social Security retirement has been forecasted to dissipate for decades now, with the advent of such coming to fruition through probable decreased deductions beginning in 2023. This is due to basic population demographics, which change over time. The baby boomers are retiring in numbers that can’t be kept up with by the current workforce in the form of wage tax as those contributing to the social security trust fund are diminishing in number. With 66 million Americans now receiving benefits at a pace of adding 5.5 million new beneficiaries each year, roughly 84 percent of Americans 65 or older rely on social security as their main source of income.

A perfect storm of events so-to-speak, beginning with the depleting social security trust fund, through the large conversion of pension funds to personal retirement accounts in the form of 401(k)’s, has led to a significant increase in bankruptcies filed by those Americans 65 and older. A bankrupt study by the Consumer Bankruptcy Project reveals disturbing statistics regarding the bankrupt seniors. According to the study, the median debt for bankrupt seniors is $101,600, or three times those filers’ average income. People age 65 or older seeking bankruptcy have median net worth’s of negative $17,390. When inflation and health care costs are on the rise, it’s not uncommon for elderly Americans to seek bankruptcy relief. And while senior citizens enjoy certain advantages over other debtors, bankruptcy won’t be the right choice for those who stand to lose a lot of property. The various types of personal bankruptcies under federal and state law are beyond the scope of this article, but one who believes they are in financial distress should not attempt to take on the bankruptcy courts without legal counsel.

According to the bankruptcy legal experts at NOLO, the following is a list of questions you should ask yourself to help determine if bankruptcy is for you.

- Do you have the type of debt that can be wiped out (discharged) in Chapter 7?

- Do you want to catch up on home or car arrearages through a Chapter 13 repayment plan?

- Can you exempt (protect) all or most of your property?

- If you have to give up (or pay for) some property, will you discharge enough debt to make filing worthwhile?

- Is your income low enough to pass the Chapter 7 means test or will you be required to make monthly payments in Chapter 13?

Difficult questions to say the least. According to Deborah Thorne, an associate professor of sociology at the University of Idaho, “Bankruptcy can offer a fresh start for people who need one, but for older Americans it is too little too late. By the time they file, their wealth has vanished and they simply do not have enough years to get back on their feet.”

The politics of the situation have made this a sacred cow throughout history, as the issue of senior security rises and falls with the latest demagoguery. Some are speaking up and offering ideas, such as raising the retirement age to 98, not really, but it might as well be. Social security is mandated by congress to only invest in risk free securities of the U.S. government. Perhaps some will offer up a plan to use Bitcoin as an investment vehicle, which would give us all the future security of the Venezuelan bolivar. Even though bankruptcies are up, it is only by a small percentage. If you are in that percentage, it matters. One would guess if the numbers increase and social media flashes images of the elderly being forced from their homes, politicians will at least pay lip service to the idea of fixing a broken system.