As we anticipate the forthcoming Federal Reserve moves to aggressively attack inflation and reduce their balance sheet, one must wonder how this is being done in the context of any kind of examination of how the Ukrainian conflict could impact growth, inflation, and monetary policy. In addition, we must also examine this with an eye toward the reduction of globalization and wonder whether the Chinese economy will turn inward, increasing the strain on China’s relations with the West. With the Biden administration saying what was once thought to be a 72-hour conflict, may actually be years or decades of conflict between Russia and Ukraine, making the economic consequences all the more vital. The pandemic has left the global economy with several key points of vulnerability, including high inflation and jittery financial markets. Aftershocks from the invasion could easily worsen both.

Let’s take a look at globalization. A perfect storm of circumstances is helping dismantle the global economic system that the United States built over the past few decades. Most Americans a month ago wouldn’t have been able to point to Ukraine on a map, let alone realize that it is one of the largest suppliers of wheat and other vital commodities in the world. Currently, how could one not contemplate that this conflict could be the death kneel to world trade? Do the daily headlines proclaiming that Vladimir Putin’s invasion of Ukraine and the subsequent imposition by the West of massive sanctions on Moscow mark the close of the era of economic globalization? Some go so far to posit this is the end of capitalism. Unlikely. As is the end of globalization. Globalization is an evolutionary process. The structure of the world’s markets, as well as their economic participants, businesses, workers, consumers, and governments, are constantly transforming. What took centuries to develop is unlikely to go away with a Russian invasion overnight.

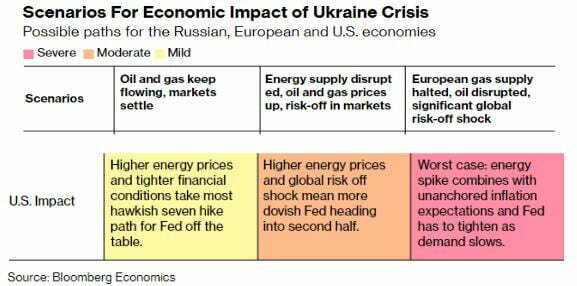

Others would disagree and have decent arguments as to why we need to bring things in-house, so to speak. BlackRock CEO Larry Fink told shareholders in a recent letter that Russia’s “decoupling from the global economy” following its assault on Ukraine has caused governments and companies to examine their reliance on other nations. On Wednesday, April 6, 2022, Treasury Secretary Janet Yellen told Congress that, “Russia’s actions will have enormous economic repercussions for the world.” She is referencing monetary policy and financial sanctions in her statement and the effects that are likely when Russia is taken out of the world’s financial system. Bloomberg Economics has captured some of those effects in three scenarios that examine how the war could impact growth, inflation, and monetary policy.

Globalization’s demise under a more draconian scenario also stems from the belief that the West’s responses to Russia will propel the establishment of an alliance between Xi Jinping and Putin such that China and Russia will counter our advanced democracies and form an integrated economic block of totalitarian dominated socialist states. However, many believe that Xi and China would actually welcome the demise of Russia as China ultimately would not want to share the political or economic stage with Putin and Russia. There are several justifications for this notion. First, China has been searching for more self-sufficiency and its strategy is all about increasing self-sufficiency whilst remaining part of global markets. While possessing an enormous landmass, self-sufficiency in agriculture looms large as China has little arable land relative to its large population. Hence the desire to initiate the One Belt One Road economic tie with Europe. There is also the need for financial self-sufficiency for China. As long as the U.S. dollar is the world’s fiat currency China cannot assume financial dominance. However, as history has suggested post World War One things can change quickly regarding the dollar.

So how does this affect the markets and your portfolio? The current military action is raising the risks of a protracted conflict within Ukraine and creating concerns about the potential impact on financial markets and the global economy. Fortunately, history shows that while geopolitical crises such as the one between Russia and Ukraine can temporarily roil markets, they don’t typically have long-term consequences for investors. According to Dirk Hofschire of Fidelity’s Asset Allocation Research Team, “In general, these types of crises tend to only have a significant and lasting impact on global financial markets if they have a sustained macroeconomic impact on major economies.” Europe is much more likely to feel the pinch than we are here in the U.S. What we will feel is market volatility, as shown in the equity markets in recent days. In addition to market volatility, the invasion is likely to add to inflationary pressures by disrupting exports of oil, natural gas, and wheat from Russia and Ukraine and raising prices.