You don’t need to be told that bitcoin and cryptocurrency, in general, is a risk-on asset class and is currently falling like a rock in price and perceived value. You already know that it is trading at multi-year lows and is locking horns with a long crypto winter.

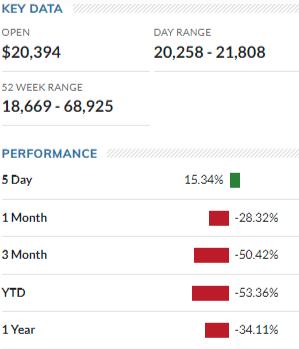

Just in case you haven’t heard, the following chart will drill home the draconian stats for you. Don’t get your hopes up on the five-day performance.

How could one possibly see an upside when the likes of Warren Buffett, Bill Gates, and Jim Cramer all have said bitcoin is doomed? It could be argued that those statistics have spelled capitulation for the crypto market and at least there’s no place to go but sideways or up.

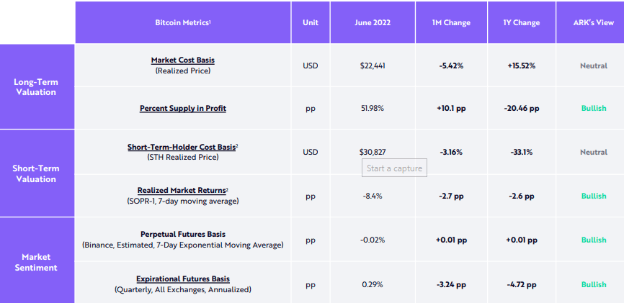

Cathie Wood and her Ark Invest fund got everyone excited about a $400,000 bitcoin price by 2025 and even $1 million by 2030. Their June investment update hasn’t retracted this, but it hasn’t actually endorsed it again either. The bitcoin metrics used by Ark are still tilted slightly to the bullish side, most notably by market sentiment, which is usually a contrarian indicator.

As the legal disclaimers state, past performance is not indicative of future results. Hence, we must look forward and see why there is a glimmer of hope for the resurrection of bitcoin. Once again, all roads must go through the SEC. Securities and Exchange Commission Chairman Gary Gensler has his regulatory eye on cryptocurrency markets, and he’s taking investors hostage, in the process.

The Holy Grail for the next phase of bitcoin will likely come through the advent of spot bitcoin exchange-traded products, or ETPs. Perhaps this sounds random, but one only has to look as far as the New York Stock Exchange and see how ETFs have opened the door for massive liquidity and have allowed the average investor to take part in the markets. It is the average investor that is at the heart of the regulatory mission for the SEC.

Gensler contends that until retail crypto markets can be regulated by the SEC there will be no spot bitcoin. It’s not for a lack of effort from the sell-side. There are currently two applications for ETPs with the SEC, Bitwise Bitcoin ETP Trust and Grayscale Bitcoin Trust, and many more have been turned down in the past.

So why all the anticipation about something called a spot ETP? Because the way people have to currently buy bitcoin is archaic ironically for the currency of the future. The idea is to offer investors an alternative to directly buying and storing bitcoin. Crypto owners can forget or lose the password to their digital wallets, while hackers can steal tokens from unsecured wallets.

The crypto market is set up for decentralized investors who don’t mind writing down a 16-digit seed code and putting it in cold storage in a safe deposit box. And they wonder why it’s not catching on with mainstream America or the world for that matter. Anyway, ETPs avoid those security risks and have the potential to not only bring in the individual investor, but institutional money as well. The crypto market will not advance until that happens. Plain and simple.

The caveat here is that ETPs are considered securities and like stocks and commodities they must garner SEC approval. “The Commission’s resistance to a spot bitcoin ETP is becoming almost legendary,” SEC Commissioner Hester Peirce said recently. But you say wait, I thought there was an ETP on bitcoin already. Yes, but that is based on the futures market, which is regulated by the CME, thus allowing such ETP to trade as a security.

According to James Seyffart, Bloomberg Intelligence analyst, “Until a spot bitcoin exchange or likely multiple spot bitcoin exchanges come under the purview of the SEC and/or CFTC, the SEC isn’t going to approve a spot bitcoin ETF.” The SEC has told spot ETP sponsors they must demonstrate that a significant amount of bitcoin trading occurs on a regulated market or that the underlying market inherently possesses a unique resistance to being manipulated.

The academic literature that has been presented to the SEC from the various participants has been overwhelmingly bullish and in favor of creating the ETP. Among other things, it will facilitate price arbitrage and bring in speculators who are necessary to take on risk in orderly markets. Also, more than 70 crypto ETPs in Europe have worked without manipulation despite volatility.

It would seem inevitable that an ETP would be established in the future, if for no other reason than when the term of Gensler is up. Prior to the latest crypto meltdown, Congress was getting on board the regulatory train in hopes of creating an efficient crypto marketplace. This may still be the case, and remember that Gensler takes his marching orders from Congress. Lawsuits will arise like the one that Grayscale has waged with the SEC for violating the Administrative Procedure Act, whatever that is.

Stay tuned and keep one percent of your portfolio in risk-on bitcoin crypto.