The ebb and flow of the free market system over time is like the tides of the ocean, where government intervention into the market expands and contracts as dictated by the current economy.

From Keynesian “priming the pump” to recent decades of crisis intervention, the federal government has again come to replace the invisible hand of Adam Smith. The notion of Washington getting involved in the private sector is nothing new. The government has essentially two methods to influence the economy, fiscal and monetary policy. If we go back to the Great Depression we see the fiscal stimulant of deficit spending and its effects on the economy.

From Herbert Hoover to FDR, the influence of John Maynard Keynes on government was ever lasting. His general thought was that the government needed to spend money on projects during times of economic weakness to get the economy in gear again. The idea of spending more than you take in in taxes was novel and not wholly understood at the time. Fast forward to recent decades and take a look at how Keynesian style deficit spending affected the economy.

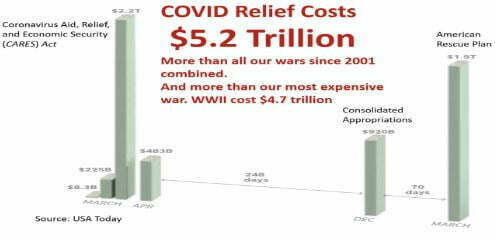

According to statistics from NASDAQ, COVID costs a total to date of $5.2 trillion. World War II cost $4.7 trillion (in today’s dollars). Overall money printing totaled $13 trillion: $5.2 for COVID + $4.5 for quantitative easing + $3 for infrastructure. Mountains of money will generally cause inflation. As we’ve witnessed in recent markets, inflation causes increases in interest rates, thus lowering bond prices. Increases in interest rates can cause reductions in stock value, particularly in technology and start-ups, where financing growth through debt raises costs and lowers the bottom line.

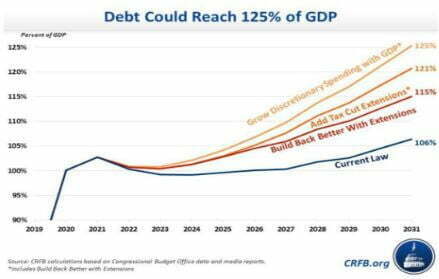

As such, the federal debt is likely to hit 109% of GDP by 2031 but could get as high as 125%. This would surpass the debt-to-GDP ratio in the years immediately following World War II. Wars are used for comparison because they are the only other events to draw upon that involve such massive sums of spending.

Currently, Congress has advanced two bills that would continue to grow the government’s footprint on major sectors of the U.S. economy. It’s hard to argue that money printing for Quantitative Easing (QE) didn’t work, so the plan is to load on a bunch more paper money. In the Great Depression, it was a domestic upheaval, with deficit spending going into pockets and becoming a large portion of the GDP of the period. This was real and tangible. The current crises are somewhat existential in that the problems they aim to tackle are obtuse with metrics that are not aligned around the globe.

Climate change and the threat of an emboldened China top the list and fighting them is a slow and arduous process that is much less efficient than brick and mortar infrastructure projects of the past. The risk is relative and ostensibly leaves Americans worse off in the short term, and even perhaps in the long run. “We are going to have bad growth,” said Douglas Holtz-Eakin, a Republican economist and former director of the Congressional Budget Office.

The semiconductor sector will assert, and rightly so, that China has propped up the industry with funding and research that goes beyond the means of American corporations. At first glance, no one is feeling sorry for the chip sector, as they have amassed incredible market share with enormous growth forecasted for the next ten years. However, the playing field has been made uneven by the Chinese government, so if we are to make sure that semiconductors are made in America for the defense and protection of the country, one should be on board for this legislation.

The case for small government in the 1980s and 1990s was advanced in academia by Milton Friedman, the Nobel Prize-winning University of Chicago economics professor. In his essay, Free to Choose, Friedman posits positions that limit government to national defense, protecting people from each other, and taking care of those who can’t take care of themselves. One could say that the government’s reach has gone light years away from Friedman’s free-hand philosophy.

The practical application of abandoning the free hand and entering the market increases the cost of living via subsidies that drive inflation. Just look at four-year college tuition from the mid-’80s to today. The cost of attendance rose almost 500%, according to data from Forbes, while inflation during that period was half the increase. Federal aid has superseded grant relief offered by most of the four-year schools, forcing many middle-income students and families to take on debt to pay for college.

Ironically the end game in higher education currently comes full circle as the Biden Administration is set to eliminate a large portion of the debt at the expense of other Americans who either didn’t go to college or did go and actually paid off their debt. It can be said that too much government spending reduces innovation in a capitalist market by crowding out private sector investment. China has historically been a case study of this. An innovator of nothing, but a perfector of everything. From electronics to automobiles, the real-world examples are numerous.

Lastly, too much deficit spending can reduce economic mobility and weaken the incentive to work. Covid 19 is the textbook example. Just ask anyone in the service sector how hard it was to find staffing when redistribution payments of $600 a month allowed many to stay home instead of going to work. Conservative states like Florida and South Carolina were quick to eliminate these disincentives to get their small and medium size businesses back up to speed.

Too much spending encourages a dependency on government that undermines risk-taking and entrepreneurship, which after all, is the backbone of our capitalistic success. You wonder why there are no European versions of Microsoft, Google, or Apple, even though Europeans obviously demand and consume the sort of products and services as those in the U.S. The reason is not the economy stupid, it’s the current regulatory regime, stupid.