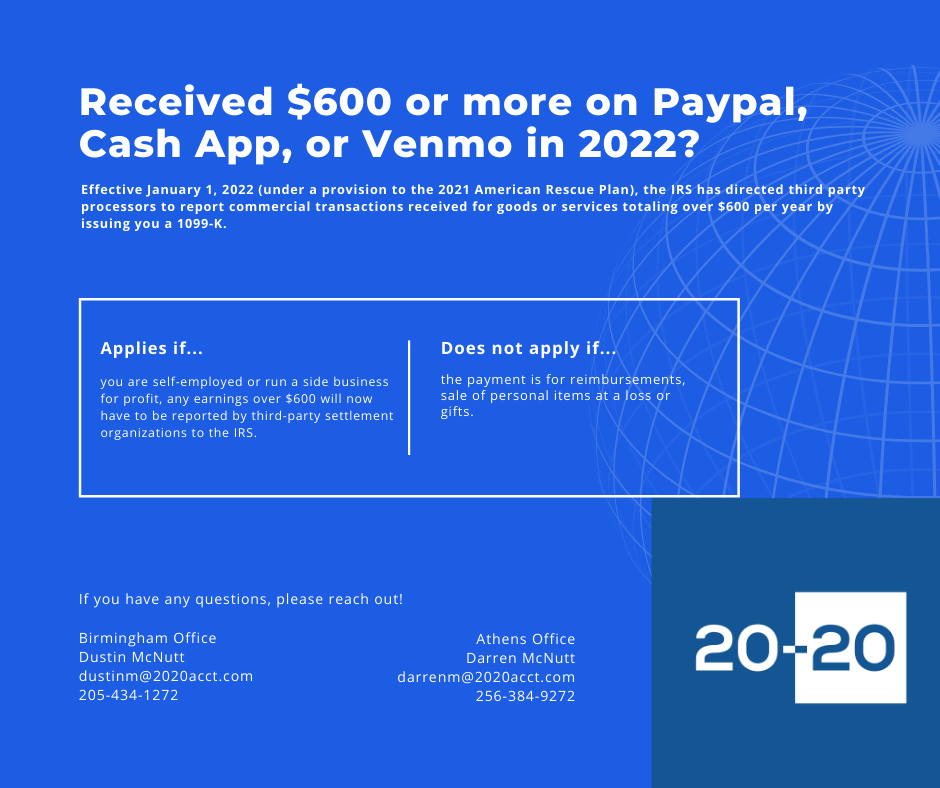

The IRS warned American taxpayers to report transactions that use “third-party” facilitators like Venmo, PayPal, Zelle, and Cash App that are at least $600 in value.

They shared tips advising U.S. businesses that make $600 or more annually from payments received through “third-party” networks to file a tax form known as Form 1099-K.

Taxpayers should report the income they earned, including from part-time work, side jobs, or the sale of goods,” as stated on the IRS website.

“The American Rescue Plan Act of 2021 lowered the reporting threshold for third-party networks that process payments for those doing business.”

The Biden regime required U.S. banks to turn over to the IRS the bank account information for all accounts holding more than $600.

The $600 Threshold

“Prior to 2022, Form 1099-K was issued for third-party payment network transactions only if the total number of transactions exceeded 200 for the year and the aggregate amount of these transactions exceeded $20,000. Now a single transaction exceeding $600 can trigger a 1099-K,” IRS added.

“The lower information reporting threshold and the summary of income on Form 1099-K enables taxpayers to more easily track the amounts received. Remember, money received through third-party payment applications from friends and relatives as personal gifts or reimbursements for personal expenses is not taxable. Those who receive a 1099-K reflecting income they didn’t earn should call the issuer. The IRS cannot correct it.”

Earlier this year, Biden signed the Democrats’ economic package that allocated billions of taxpayer dollars to expand the Internal Revenue Service’s workforce.

The IRS would receive $80 billion if H.R. 5376, the $750 billion “Inflation Reduction Act” passes the House and lands on Biden’s desk. The funding would mark a 600 percent increase from 2021 when the bureau received $12.6 billion.

The Controversy

The most controversial component of the program is IRS enforcement and the 87,000 new agents being added to the force.

The reconciliation package would double the current IRS workforce by hiring an additional 87,000 employees to the bureau’s staff of 78,661 employees.

At 165,661 employees, the IRS is poised to become larger than the Pentagon, State Department, FBI, and Border Patrol combined total employees of 158,779.

This stepped-up enforcement, the public was told about, would affect big corporations and people who are making over $400,000, although….that’s not really how it works with the IRS.