The excitement around artificial intelligence and AI stocks seems to be hitting new highs daily. As a matter of fact, chip maker Nvidia just reached a market capitalization of $1 trillion. Nvidia is still a play, albeit wildly popular among hedge funds and institutional types, but you might have to dig a little deeper to find less visible opportunities.

One must first take a step back and ask if this latest craze is just another tulip bulb frenzy, or does it have legs with lasting financial implications.

Technology can make people get carried away with notions that may or may not pan out. One reason is that understanding technology and how it works is out of the realm of most people.

As such, we rely on the hype created by stock promoters and the media, which can get the better of our judgment. Also, the psychology behind this frenzied investment is generally the same.

People would prefer to have a dollar in their hand today rather than two dollars in their hands in the future. Instant gratification takes hold, and investors can get greedy and not see the forest through the trees. These tenants all go against value investing in the Graham and Dodd style of Buffett and Munger.

They took the long-term value approach. It helps that they have lived to almost one hundred to see the benefits. Perhaps AI can be a combination of both exponential growth and long-term success.

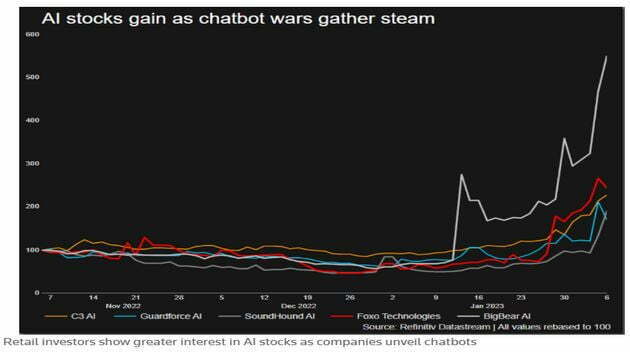

In addition to large players, retail investors are piling into small-cap firms that are into building artificial intelligence tools as companies, including Google parent Alphabet and Microsoft, jostle to pull ahead in the race for the next big growth driver.

According to Matthew Tuttle, chief executive officer of Tuttle Capital Management, on the reason behind retail investors’ focus on the smaller firms, “Small-cap firms have AI as a much larger part of their business than the larger ones.”

The following depicts the exponential recent growth.

Let’s look at some of the small cap AI companies that could lead the way.

Innodata NASDAQ: INOD

Innodata is a technology company that provides comprehensive data processing and management solutions. The company’s expertise lies in leveraging cutting-edge AI and machine learning (ML) technologies to empower its clients with effective problem-solving capabilities. Shares of INOD have been performing well this year, with the stock up 281% YTD and 70% during May.

SoundHoundAI NASDAQ: SOUN

As the name might suggest, SoundHoundAI specializes in AI solutions for voice-enabled devices and mobile applications. The company is a pioneer in voice recognition technology. The company is working with the auto industry, integrating voice assistants into vehicles.

The auto industry segment could be massive for SoundHoundAI, with the company expecting 90% of new cars to have voice assistants. SOUN trades at $2.86 a share and is up 61% YTD.

BigBear.ai Holdings NYSE: BBAI

The company operates in two segments, Cyber & Engineering and Analytics, and offers high-end technology and consulting services. BigBear.ai empowers its customers with real time decision making capabilities by aggregating, interpreting, and synthesizing data. That’s a mouth full.

Its top clients include the U.S. Army, the Defense Intelligence Agency, and the U.S. Air Force, in addition to numerous logistics and shipping companies. Oppenheimer analysts have a market-perform rating on the stock, with a $10 price target.

Nerdy, Inc. NYSE: NRDY

The company operates an online platform for live learning that uses AI to personalize learning lessons for each individual user. The company announced the launch of its AI-Generated Lesson Plan Creator and AI-Generated Chat Tutoring. It also integrated ChatGPT into its suite of products.

Perhaps the most assuring information comes in the form of putting your money where your mouth is. Its CEO, Chuck Cohn, is so bullish he bought $30 million worth of stock since May 2022.

Additionally, he told the St. Louis Post-Dispatch: “I think the shares are deeply undervalued, and I purchased them as a result of my conviction about the company’s new business model.” Can’t get much more bullish than that!