Capital is the engine that drives business, and until the Great Recession it was almost exclusively provided by banks. From Wells Fargo to your community credit union, these were the only avenues open to you for financing. This has set the stage for entrepreneurs in the financial lending world to do what capitalism does best, solve a problem by filling the voids.

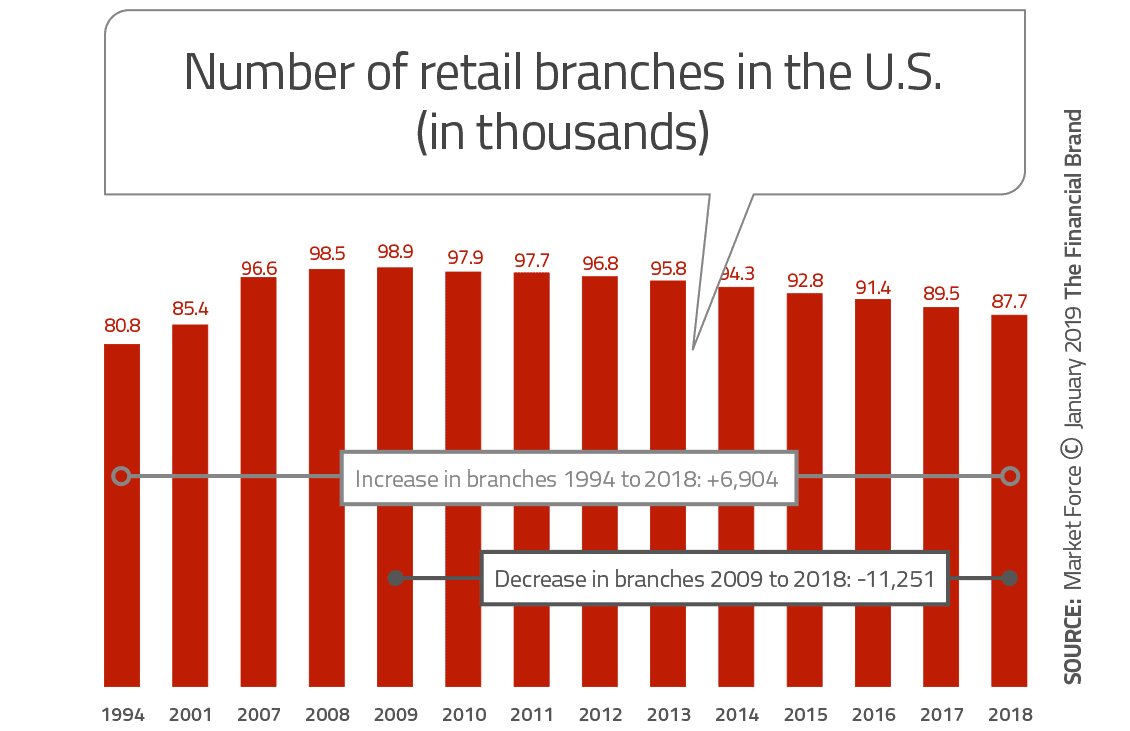

Enter non-traditional sources of lending. Before moving on to the benefits of these new funding channels, one must first realize that the banking landscape is probably changing forever. While the largest banks are on solid footing, the number of mid-sized and community banks are declining.

I remember the days of waiting in line at my local branch office of BB&T to make a simple deposit. I drive by that same branch most days of the week, and never see more than two cars in the parking lot. They will either adapt or disappear, and sell their almost always prime real estate location to some condo developer or fast food chain. With that said, the nearly 15-year economic expansion could be in its final innings, raising the odds that risky loans made late in the cycle will turn into delinquent ones. Only time will tell.

For you as this competition is good. It will bring choices that were not previously available, which will ultimately lead to a lower cost of money.

The banking industry as a whole has still been reluctant to go online with their lending, according to a recent survey by the FDIC. The FDIC found that nearly every bank accepts applications at branches.

However, despite the digital revolution in small business finance, the study found that very few small or large banks accept small business loan applications online. As Warren Buffett says of the print news business, that it is a dead dinosaur, so may be the conventional small business loan.

The primary reason is that the next big group of borrowers will be millennials. According to Rohit Arora, CEO of Biz2Credit, “At my company, more than 60 percent of loan applications are done via smart phones. This trend is not reversing anytime soon.”

Don’t think that the advent of Fintech will cause banking to disappear. Remember, lending is just one function of a profitable bank. According to Oliver Wyman research, only 42% of individuals have consolidated their primary checking, credit card and merchant acquirer relationships, a key opportunity for banks. These types of relationships are often more profitable than the lending arm. Look at what Capital One has done.

They are not only changing the retail landscape with a boutique experience, but are making “bank” on credit card fees. My guess is that everyone reading this has been solicited by them via mail in the last month. So while it might seem as though the tech upstarts have the upper hand in an increasingly digital economy, traditional lenders soon will be able to mount a powerful counterattack. Competition and capitalism are once again shown to be good for your small business.