The U.S. has reached both an inflection point and a tipping point in regard to the economic effects of an open borders immigration policy. The topic has always been the red headed step child, in that those in the know where aware of it, but didn’t want to tell the dirty little secret to the rest of us. We’ve seen in increasing abundance of late disturbing images from the southern border depicting a massive migration into the United States. Let it be said first that this is certainly a humanitarian crisis, with anyone having a heart understanding the toll it is taking on the vast majority of those standing in line to swim across the Rio Grande et al to enter America. With that said however, what you don’t hear on the evening news are the deleterious financial consequences that go along with it.

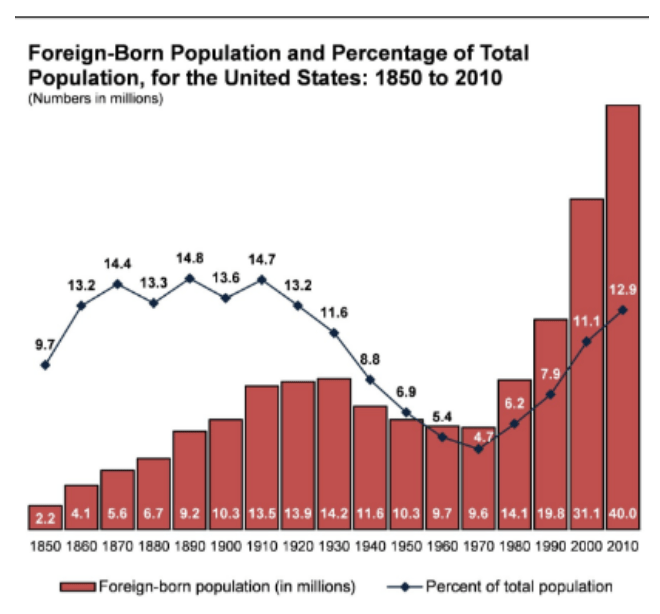

Prior to the numbers increasing almost exponentially, in the mid 2010’s studies suggested that immigration into the United States was a net positive. According to the National Academies of Sciences, Engineering and Medicine, America’s immigrant population climbed by more than 70 percent between 1995 and 2014, when it stood at 42.3 million, accounting for roughly 13 percent of America’s total population.

The primary economic concern centers on the added pressure on the work force and whether the marginal productivity is positive or negative. Regardless of whether we view this labor as legal or illegal, the aggregate influence must be what is analyzed. One must note that the influx of immigrants is one that almost exclusively occupies the lower tranches of the labor market. The changing demographics in America have produced a continued need for surplus labor in areas that were either occupied by local workers or are entirely new today. This directly contradicts one argument that immigrants are taking jobs away from native Americans. However, although immigrants increase the supply of labor, they also spend their wages on homes, food, TVs and other goods and services and expand domestic economic demand. This increased demand, in turn, generates more jobs to build those homes, make and sell food, and transport TVs. Standard economic theory implies that while higher labor supply from immigration may initially depress wages, over time firms increase investment to restore the amount of capital per worker, which then restores wages. We must remember that not all immigration labor is in the lower tranches. Immigrants also bring a wave of talent and ingenuity, accounting for a disproportionate share of workers in the fields most closely tied with innovation. A 2021 survey of the top fifty venture capital funded companies found that half had at least one immigrant founder and three quarters had immigrants in top management or research positions.

Data will show that immigrants in general, whether documented or undocumented, are net positive contributors to the federal budget. However, the fiscal impact varies widely at the state and local levels and is contingent on the characteristics of the immigrant population, including, age, education, and skill level living within each state. Prior to the recent massive wave of illegal immigration this notion of being net positive was plausible. More often than not, immigrants are less educated and their incomes are lower at all ages than those of natives. As a result, immigrants pay less in federal, state, and local taxes and use federally-funded entitlement programs such as Medicaid, SNAP, and other benefits at higher rates than natives.

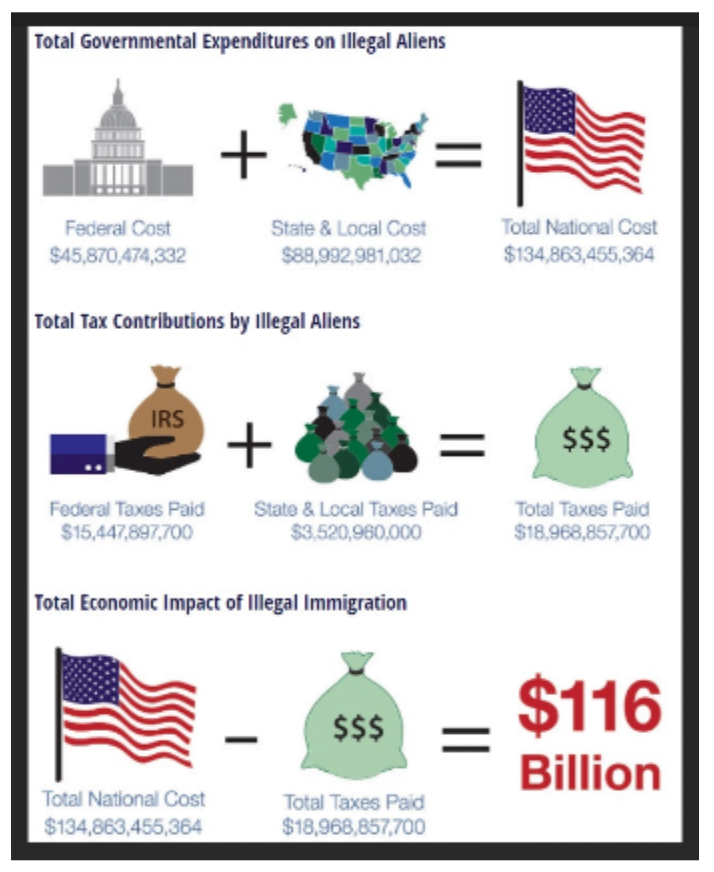

According to the Federation for American Immigration Reform (FAIR), the net cost of immigration increased from the $113 billion their 2010 study found to $116 billion now. Even after accounting for taxes paid by illegal immigrants, they’re still a massive burden on the overall economy. Nobel laurate Milton Friedman was probably correct in his day by saying that illegal immigration could actually be preferable to legal immigration, as illegal immigrants wouldn’t be able to benefit from our welfare state as non-citizens. If only he was right.

While illegal immigrants are estimated to pay roughly $19 billion in taxes, there are a myriad of those who pay no taxes at all. An argument could be made that these same jobs being performed by immigrants would be performed by citizens at a higher wage, thus resulting in greater tax revenue for the government.

In the long run, many economists say, immigration is a net economic positive. Because most newcomers are in their prime working years, they tend to contribute more in taxes than they draw in federal benefits. This is especially important as the U.S. population ages. Immigrants, whether high or low skilled, legal or illegal, are unlikely to replace native-born workers or reduce their wages over the long-term, though they may cause some short-term dislocations in labor markets.