The largest lending institutions in the U.S. are set to release their first quarter earnings reports this week. The data from these 10-Q’s often gives investors insight into market particulars, including interest rates, real estate, bond prices and overall equity values. Returns are particularly interesting this quarter as investors are more indecisive than ever about the direction of interest rates and Fed moves for the remainder of the year. Just when we told you that rates have probably peaked, along comes hotter than expected inflationary data that seems to mean that rate reductions are not a sure thing.

Let’s take a look at some of the financial data that was released today by JP Morgan Chase, Wells Fargo, and Citigroup, among others.

JP Morgan Chase:

- The first quarter financial results for 2024 were released, detailing the firm’s performance and assets, which include $4.1 trillion in assets and $337 billion in stockholders’ equity as of March 31, 202

CitiGroup:

- Citigroup’s profit fell by 27% but still managed to beat expectations. The drop in profit was attributed to expenses, including those from the bank’s restructuring plans, which offset revenue gains from some of its biggest businesses.

- The earnings per share reported were $1.58, surpassing the expected $1.23. The revenue reported was $21.10 billion, against the expected $20.4 billion.

Wells Fargo:

- Wells Fargo reported a 7% decline in first quarter profit as high funding costs and lower loan balances took a bite out of net interest income.

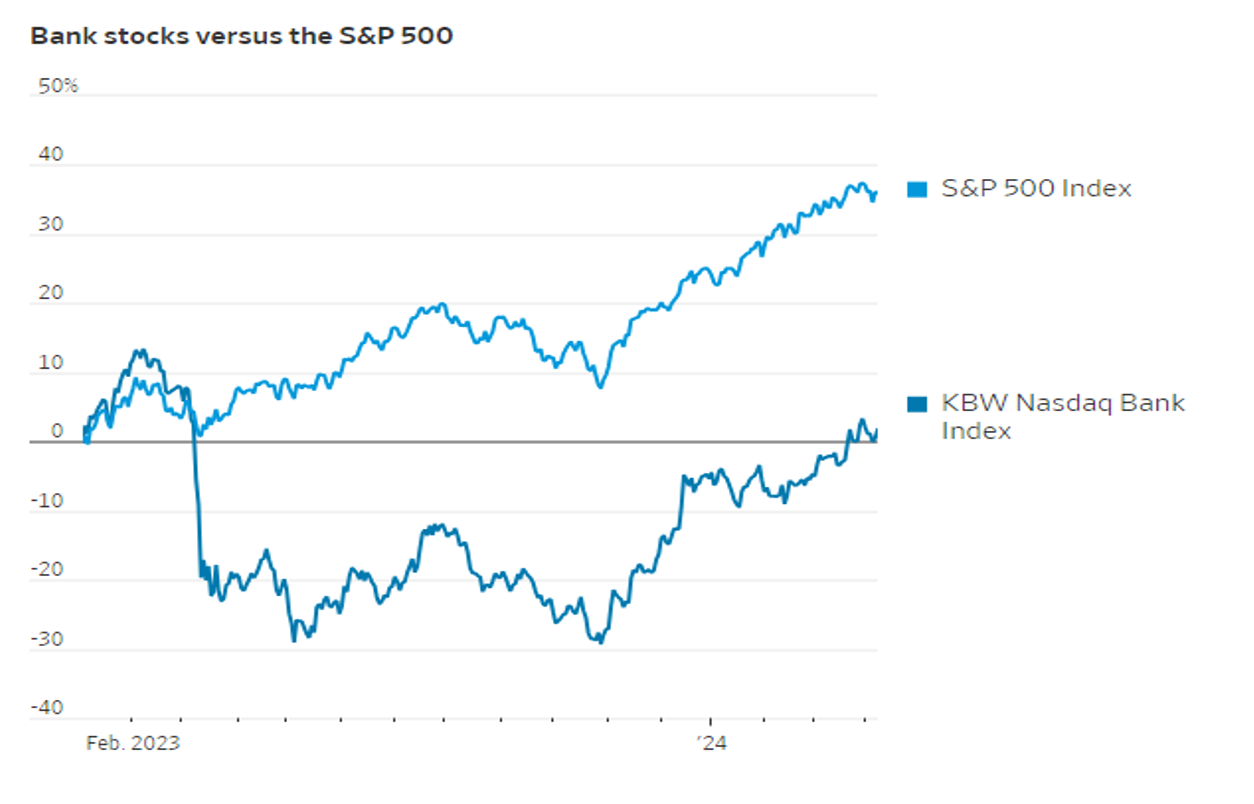

Banks have underperformed in comparison to the market in general as investors have factored in potential losses on bond portfolios and commercial real estate holdings. The following chart depicts this showing the bellwether banking index compared to the S&P 500. According to Wells Fargo analyst Mike Mayo, “Fear of rates, recession and regulation have overtaken the reality of performance for bank stocks.”

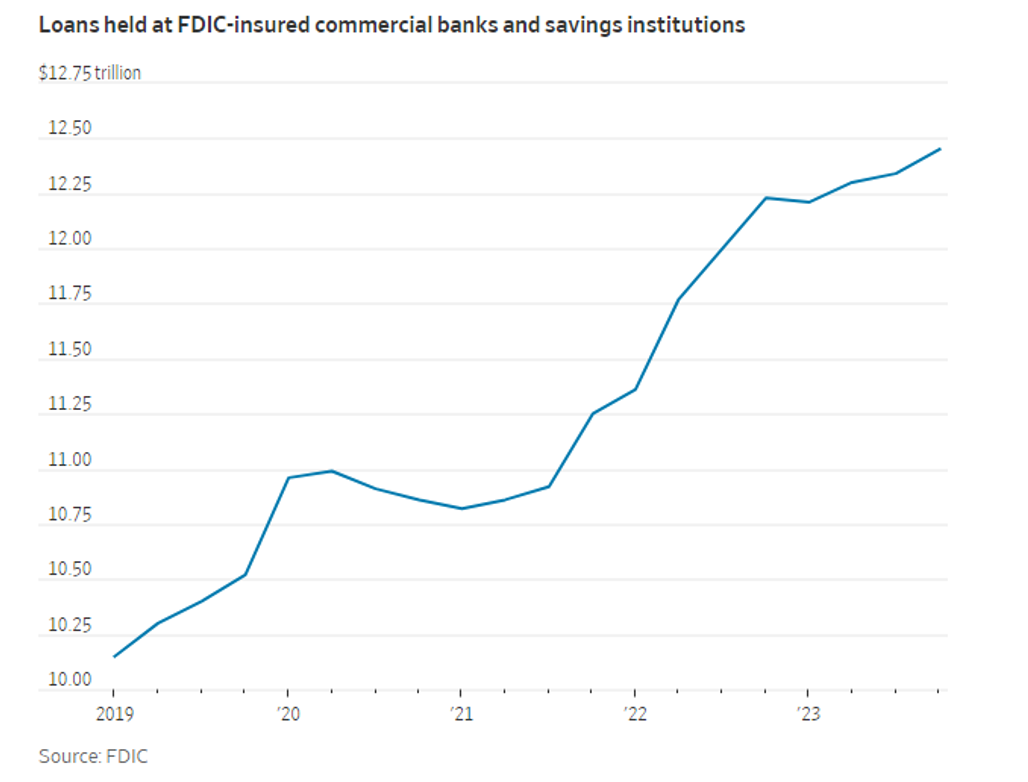

Commercial real estate is front and center of the actual and perceived issues facing not only these large money center banks, but also small and regional banks, which hold a disproportionally larger share of real estate loans to equity. With banks in general holding over half of all the debt backing office, retail, and other nonresidential properties in the U.S., it’s no wonder why Fed Chairman Powell has said openly that there will be more bank failures to come.

One has to think that the day of reckoning for banks and other lenders in commercial real estate has yet to come. The changing office habits and city demographics have taken longer to unfold, with it being four years post-pandemic and we’re still trying to understand whether workers will be going back to office space in cities on a permanent basis or not. You have to remember too that leases on office spaces are typically done for many years, so this unwinding may have yet to fully take place. In addition, we’ve seen landlords extending other leases in the short-term, perhaps fending off what may be a wave of vacancies in the future. According to Anne Walsh, the chief investment officer of Guggenheim Partners Investment Management, “The commercial real-estate pain in the office sector is just starting.”

This could lead one to believe that we might be in for more of a rolling recession when it comes to banking and commercial real estate, as term leases with durations of 5 to 10 years continue to unwind at different intervals. This won’t make the overall health of the sector any more sanguine, but the more spread out it is, the less likely the markets will react vehemently negative.

The secondary issue of concern relates again to the overall banking portfolio, but is on the other side of the ledger. Banks utilized the ostensibly free money for the past decade or more and filled their balance sheets with low coupon rate bonds. That’s a great formula for banks as long as rates stay low. As we know, rates have risen in the past two years, and as rates rise, the value of the bonds in a portfolio will drop. No big deal really if these bonds are held to maturity, but if capital is needed and the bonds have to be sold, losses would ensue. According to data from the FDIC, after the Fed started raising interest rates to curb inflation, the value of those bonds fell, pushing up unrealized losses on securities in the banking system to $478 billion as of Dec. 31, 2023.

While bond portfolios and commercial real estate pose the greatest risk to the banking system, inflation and higher rates are also affecting consumers in the form of credit card debt and auto loans, as well as mortgage debt. Banks are getting pinched here as well, as defaults on these consumer loans are hitting new highs.

In the big picture, the commercial real estate outlook for 2024 suggests multifamily and neighborhood retail remain strong, while the future of office buildings remains unclear due to the uncertainty around longer term vacancies and interest rates. Any way you slice it, it appears that there is more pain for the banking and commercial real estate sector in the not too distant future.