I don’t think many people remember the days when the local drug store was a focal point in communities, where children gathered at soda fountains and adults picked up medicine and other sundry items. I certainly don’t, and the corner drug store model of old has morphed into one in which, while similar, is also in danger of going extinct. Walgreens and CVS are struggling, albeit still on every corner across America. The same can’t be said for Rite Aid, the one-time behemoth, who is now in bankruptcy. So where do our drug stores go from here?

I for one don’t want to see the local drug store go, but there are several reasons why their existence is tenuous. During and post-Covid you could see the burnout in the faces of the pharmacy and staff. Not unlike front line responders in all areas of healthcare. It’s always been a demanding profession, and we’re still seeing the signs of over working in the current market.

Instead of expanding stores and building out new locations, drug stores are closing locations as fast as they used to build them. As such, fewer pharmacists are needed, and the ones that remain continue to feel the stresses of being pulled in many directions. According to Jefferies analyst Brian Tanquilut, “As things have started to normalize, we’re reverting back to the challenges that the retail pharmacy industry had faced even before Covid.”

Perhaps the biggest challenge is that the reimbursement rates for prescription drugs have fallen, and profits have fallen with them. This is a direct result of how the distribution system is set up, utilizing middlemen who can dictate prices to pharmacies. Pharmacies typically buy their medications from a distributor and then get reimbursed by pharmacy benefit managers, or PBM’s. The powerful drug supply middlemen also negotiate discounts with manufacturers on behalf of insurers and create lists of medications covered by health plans. The uber large players handle roughly 80% of the prescription market. Brian Tanquilut goes on to say “There’s no leverage. There’s no negotiating power on the side of the retail pharmacies.”

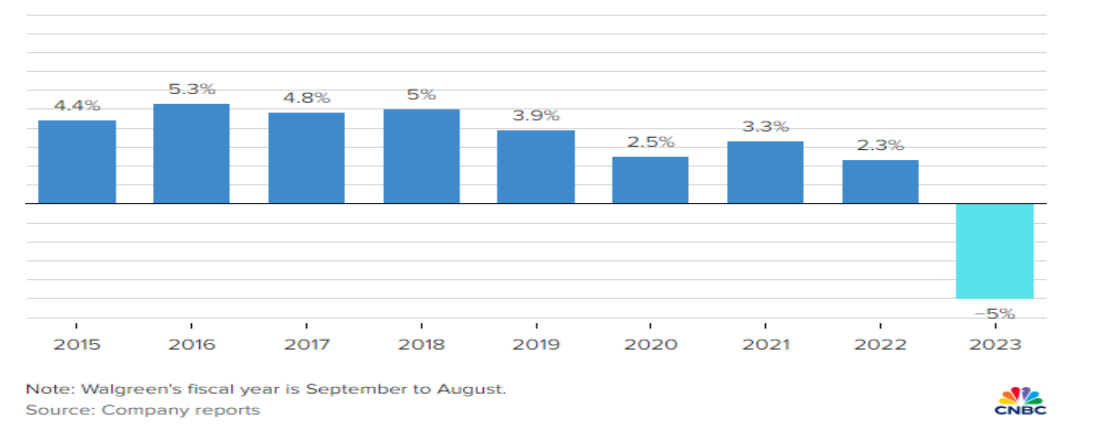

Competition is no stranger to the world of pharmaceuticals. Everything from grocery stores to online wholesalers have cut into the margins of traditional drug stores. Albeit small to date, the competition has had an effect on the bottom line. The operating margin for Walgreens’ U.S. retail pharmacy unit was -5% last year, down from 3.9% in 2019 and 4.4% in 2015.

It’s not just the pharmacy that lies at the heart of the problem. As you are aware, the pharmacy is in the back of the store, allowing customers to peruse the aisles on the way to and from picking up their prescription. This is by design and is known as shopping the front of the store. This too is on the decline. The drug stores are not only getting beat to the punch in-house, but also online. According to Leerink Partners analyst Michael Cherny, “It wasn’t as likely that an individual pre-Covid, or even the early days of Covid, would think first and foremost of going to CVS.com or Walgreens.com for shopping.”

The current retail model is broken, but is not likely to go away anytime soon, despite the shortcomings mentioned. We must remember we are an aging society, with baby boomers in charge, resulting in this demographic needing the prescription services provided by the local drug store. For now at least. Walgreens is attempting to change its footprint by adding some 100 new stores that are smaller, with less front of the store merchandise other than their own branded products.

Until such time as new models prove market ready, old fashioned cost-cutting will likely take center stage. In uncertain revenue times, the one alternative is reducing the expense side. This primarily means closing stores. With only 75% of its chain stores profitable, Walgreens is likely to target and shutter many of the unprofitable 25%. According to CEO, Tim Wentworth, “We have recently exhibited the ability to, and will continue to make difficult decisions that benefit our business, as we identify opportunities that unlock value, validate existing pathways and lead [Walgreens] into a successful future.” CVS isn’t far behind. In 2021, they announced it was shuttering 900 stores, or nearly 10% of its U.S. retail locations, over a three-year period.

Other than controlling costs and market testing, no one seems to have the answers for now. Closing stores is likely to put a band aid on the larger problems under the surface, but will keep investors at bay for a time. Congressional action may be required to change the model and eliminate the middlemen, but that is a long, arduous process that can’t be counted on.