As if the U.S. economy needed another setback. Rising interest rates and inflation, coupled with double-digit market declines on a year-over-year basis are quite enough, thank you. Those of you who may have been watching golf or the beginning of basketball’s March Madness may not have noticed this weekend, but you woke up Monday wondering whether your savings account is good to go.

The first financial shoe dropped on Friday with the revelation that the government was seizing control of Silicon Valley Bank (SVB), which was quickly followed by the closure of Signature Bank on Sunday, the nation’s third largest one. Is this a Bear Stearns/Lehman Brothers moment, or is this latest financial disaster under control?

It’s impossible to say at the moment. Important issues like sea turtle rights and transgender bathrooms will have to take a back seat for a while until this is all unraveled.

For one thing, bank financial statements are notoriously difficult to interpret, even among the most seasoned analysts. Anyone who claims that they know the entire financial picture of each individual regional bank today is either prescient or untrue. Lines of depositors outside of SVB bank branches are disturbing on many levels.

Albeit not 1929 bad, where fellow Americans were lining up for soup and selling pencils for a nickel on the street to survive, it still makes one have to wonder whether a life savings is secure at your local regional bank. The hyperbole spoken by SVB president Gregory Becker last week to “stay calm” was the foreshadowing of events to come. It is also worth mentioning that Becker allegedly sold some $3.6 million worth of SVB shares last week. Fortuitous timing.

Let’s look at the impact on the consumer and everyday bank depositor first, because that’s what’s most important. According to Kate Dore, CFP at CNBC:

- Despite the Silicon Valley Bank and Signature Bank failures, most consumers don’t need to worry about bank deposits, experts say.

- The standard coverage from the Federal Deposit Insurance Corporation is $250,000 per depositor, per bank, for each account ownership category.

- The bigger risks to investors may be exposure to tech and regional banks, but advisors are warning clients not to make emotional money moves.

Another warm and fuzzy came from the Commander and Chief on Monday. “Every American should feel confident their deposits will be there if and when they need them.” Okay, we’ll breathe a little easier for now, but the fallout for investors and associated businesses is substantial.

It’s estimated that the 2008 bailouts cost some $500 billion, according to an MIT analysis. That’s not real money to regular people, because it doesn’t affect their day-to-day lives. It’s just money magically created by the government to solve another big problem. But standing in line to get your life savings out of a bank is something the average Joe is relating to.

So what happened anyway?

It began last Wednesday when SVB announced it had sold a bunch of securities at a loss and that it would sell $2.25 billion in new shares to shore up its balance sheet. That triggered a panic among key venture capital firms, who allegedly advised companies to withdraw their money from the bank. SVB didn’t have the liquidity to cover short-term liabilities, and when depositors wanted money that wasn’t there, the FDIC had to step in and take control of the bank.

The fallout is likely to only be contagious at the regional level if at all. Even though you saw a 24% decline in Charles Schwab Monday, the money center banks like Wells Fargo and JP Morgan are well-capitalized.

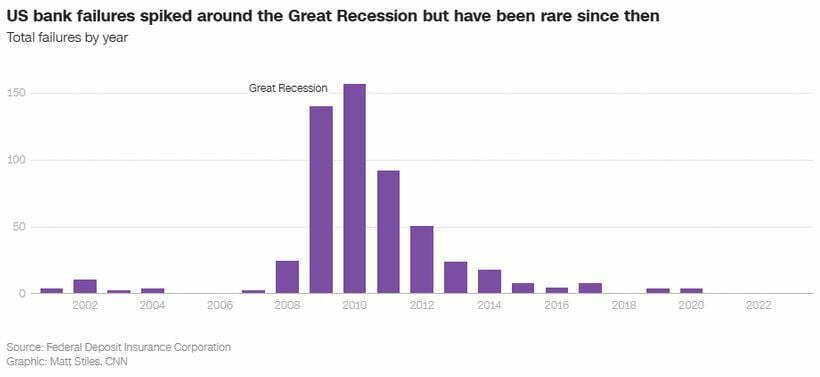

Even if capitalization came into question at the larger financial institutions, it would still be noted that the diversification of deposits, not of employees, is what matters at a bank. If you look at the following chart, you’ll see the high level of bank failures tied to the Great Recession, with such numbers not likely to be attainable again.

Ultimately it will likely be shown that the failure of SVB and other regional banks with highly correlated depositors and those that placed a short-term bet on interest rates not rising by buying treasury bonds will be about such risk management. Here’s the thing. We understand and are willing to pay the price as a nation for FDIC insurance on our savings of up to $250,000.

What we should not be willing to pay for is coverage beyond that for the uninsured. After all, you weren’t asked and wouldn’t have been able to participate in the upside of these investments had they not gone bad. And by the way, they have gone very well for the last thirteen-odd years.

My guess is you weren’t invited on any ski vacations or offered preferential loan treatment by SVB during that time. Perhaps unless it was for climate change or DEI, and then the vaults would have been opened for sure. No one should really be surprised when unqualified people are put in charge of departments that needn’t be there instead of allegedly no one being in charge of the risk management department. This is what you got as a result of the bailouts in 2008.

This time, the cost might be a little more cryptic, or should I say crypto. It’s thought that this latest tit-for-tat between Wall Street and the White House will be for control of currency and probably for control of your personal world.

Central bank digital currencies (CBDC) are on the drawing board in central banks around the world, and if the Biden administration gets four more years, CBDC will be coming to America as well.