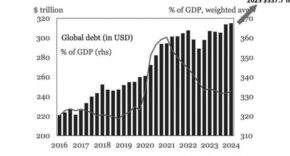

The U.S. economy was resilient, with a 2.1% annual expansion from April to June, despite elevated borrowing costs for consumers and businesses.

The government’s initial projection of a 2.4% annual growth rate for the last quarter was revised downwards.

The Commerce Department’s second estimate of Q2 growth showed a slight uptick from the 2% annual growth rate in the first quarter. Despite the Federal Reserve’s efforts to control inflation through interest rate hikes, the economy has managed to sustain expansion, buoyed by ongoing hiring and consumer spending.

The recent report on the nation’s gross domestic product indicated that the growth was propelled by increases in consumer spending, business investments, and expenditures by state and local governments. Additionally, a measure of consumer prices within the report exhibited a cooling in inflation, which could alleviate pressure on the Federal Reserve to raise interest rates further.

Eugenio Aleman, chief economist at Raymond James, highlighted, “Lower growth and weaker price increases are good news for the Federal Reserve.”

Although the economy experienced a slowdown due to the Federal Reserve’s efforts to curb inflation, it continued to expand, with businesses hiring and consumers spending. The latest GDP report highlighted the growth drivers as consumer spending, business investment, and government outlays.

The report displayed a moderation in consumer price increases, which might lessen the Fed’s need to raise interest rates again. Eugenio Aleman, chief economist at Raymond James, pointed out the positive implications: “Lower growth and weaker increases in prices are good news for the Federal Reserve.”

While economic expansion remains steady, job openings continue to surpass pre-pandemic levels. Unemployment remains low at 3.5%, only slightly above a multi-year low. The August jobs report, due to be released soon, is projected to indicate a slower pace of hiring but still reflect an addition of 170,000 jobs, according to economists surveyed by FactSet.

The declining inflation, ongoing economic growth, and consistent but slower hiring has raised optimism for a “soft landing,” wherein the Federal Reserve effectively curbs high inflation without triggering a severe recession.

The government’s second estimate of Q2 growth is the middle step of a three-step process.

A final calculation will be available in the coming months.